- Competence center for commercial real estate financing in Europe

- Elaboration of the details under the guiding principle "Growing.Together"

- Sascha Klaus designated Chairman of the Board of Management of the new real estate bank

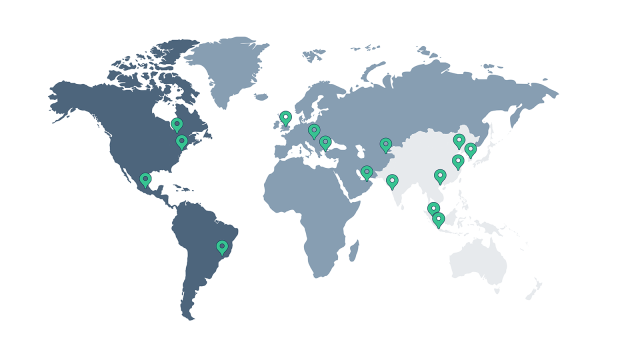

LBBW strengthened its commercial real estate financing activities in 2022 with the acquisition of Berlin Hyp. Since then, the company has been successfully integrated into the Group, regulatory requirements from the acquisition have been met and the cooperation has been successively expanded. In a next step, LBBW is now bundling its activities under the Berlin Hyp brand, which will be integrated into the parent group and continued there as an organizationally independent unit. The entire commercial real estate financing business, including international activities, will be combined in the new real estate bank. The unit is to be established under the leadership of Sascha Klaus, Chairman of the Board of Management of Berlin Hyp, in the first half of 2025.

"We are establishing a high-performance real estate bank that, as an integral part of LBBW, will significantly increase our clout in one of our core business areas. By bundling our activities, we will increase our relevance in the market and at the same time realize economies of scale and efficiency gains," says Rainer Neske, Chairman of the Board of Managing Directors of LBBW.

The transition is the logical continuation of the previous path. Following the takeover in summer 2022, Berlin Hyp was successfully integrated into LBBW and the cooperation was successively expanded. For example, the risk management of both banks has been under central management since last year. The creation of the single real estate bank further simplifies processes and the management of business activities. At the same time, there are synergies on both the income and cost side, for example through the reduction of duplicate structures. This is expected to lead to a reduction of around 300 jobs across the Group. Some of these will be absorbed by other growth initiatives within the Group and demographic developments. The bank will organize the other part in a socially responsible manner together with employee representatives. Berlin Hyp will also migrate to LBBW's core banking system as a technical platform. A clear advantage for customers: The new competence center has proven real estate expertise and at the same time can draw on the broad capabilities of LBBW, which is positioned as a universal bank. The details of the transition will be worked out in the coming months by a joint project team under the guiding principle of "Growing.Together".

"The successful development of recent years shows that we are on the right track. In the new structure, we are now scaling our business model and creating one of the leading commercial real estate financiers in Europe. This will enable us to leverage the strengths of both banks even better for the benefit of our customers," says Thorsten Schönenberger, who is responsible for the Real Estate and Project Finance segment on LBBW's Group Board of Managing Directors.

Despite the difficult situation on the real estate markets, the segment recorded strong profit growth of 65% to EUR 190 million in the first half of 2024. Together, LBBW and Berlin Hyp have an exposure of EUR 63 billion in commercial real estate financing, around half of which comes from Berlin Hyp. Formally, the new unit is a dependent institution under public law within LBBW. This model is based on that of BW Bank, which as LBBW's customer bank is responsible for corporate and private customer business in Baden-Württemberg.

"With the new real estate bank under the successful and respected Berlin Hyp brand, we are further sharpening our profile as an innovative real estate financier and at the same time strengthening our presence in the market," concludes Sascha Klaus, designated Chairman of the Board of Managing Directors of the new unit.

Your point of contact

Do you have questions?

Angela Brötel