Climate Change hits Sovereign Creditworthiness

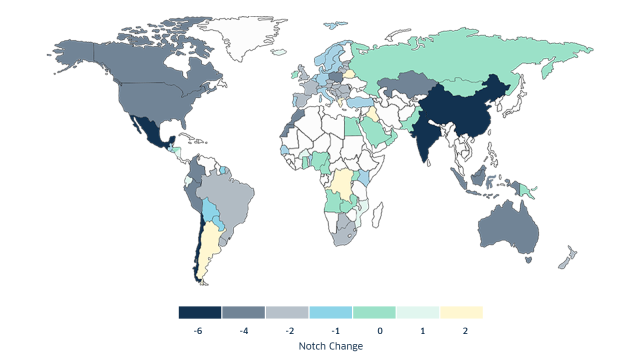

Chief Economist Moritz Kraemer and researchers at the University of Cambridge have published a scientific article on the influence of climate change on sovereign ratings. A simulation shows that creditworthiness could be impacted more than during Subprime or Covid-crises. Particularly China, Chile and India could be downgraded significantly.

Rising Temperatures, Falling Ratings: The Effect of Climate Change on Sovereign Creditworthiness

by Patrycja Klusak, Matthew Agarwala, Matt Burke, Moritz Kraemer and Kamiar Mohaddes, 7 August 2023

The Institute for Operations Research and the Management Sciences

The market fallout from the collapse of Silicon Valley Bank (SVB)

The collapse of US-based Silicon Valley Bank (SVB) has sent shockwaves across global financial markets. However, this is not a Lehman moment. Not by a long shot. The bank failure is due to a uniquely risky business model and entrenched risk management failures at the SVB. LBBW analysts explain why there is no read across to European banks and why we have not adjusted our monetary policy calls.

1.4 MB | March 14, 2023

Download study