With its robust and balanced business model, Landesbank Baden-Württemberg (LBBW) further improved its net consolidated profit before tax and capitalization in 2015. On the basis of preliminary figures, IFRS net profit before tax climbed to EUR 531 million, up from EUR 477 million in 2014. This marks the seventh consecutive year in which the Bank has increased its net profit for the year. At the same time, it has been consistently in the black for 16 quarters. "This shows that with our consequent focus on customeroriented business we have a very solid position," said Hans-Jörg Vetter, Chairman of the Board of Managing Directors.

Improvement in preliminary IFRS net consolidated profit before tax to EUR 531 million (previous year: EUR 477 million) Increase in preliminary HGB net profit for the year before tax to EUR 386 million (previous year: EUR 333 million) Revenues stable despite difficult underlying conditions Solid risk structure and strong capital base: Common Equity Tier 1 (CET1) capital ratio of 16.4 percent and total capital ratio of 21.9 percent (in accordance with CRR/CRD IV phase-in)

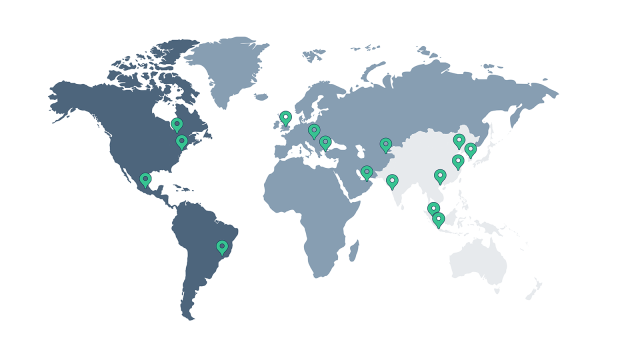

Net profit for the year under HGB (German GAAP) accounting improved to EUR 386 million before tax (previous year: EUR 333 million). IFRS consolidated net profit after tax came to EUR 422 million, thus falling slightly short of the previous year, in which an extraordinarily low tax rate was recorded on account of non-recurring effects. "We worked hard to achieve this respectable result," Vetter said, alluding to the persistent phase of low interest rates, high regulatory requirements, intensive competition and the changes in the industry brought about by digitization. On the one hand, 2015 was characterized by favorable economic conditions in LBBW's core market. On the other, however, underlying conditions especially in the banking sector remained challenging. Extremely low interest rates and the competitive market environment – particularly in the corporate and private customer business – exerted pressure on margins. At the same time, regulatory requirements continued to grow. Against this backdrop, the Bank reinforced its capital resources once again. At the end of 2015, the CET1 capital ratio stood at 16.4 percent (CRR/CRD IV phase-in), up from 14.6 percent in the previous year. Under CRR/CRD IV fully loaded, the CET1 capital ratio came to 15.6 percent (previous year: 13.6 percent). The total capital ratio rose to 21.9 percent under CRR/CRD IV phase-in and to 21.4 percent on a fully loaded basis (31 December 2014: 19.9 percent phase-in and 18.9 percent fully loaded). At the same time, risk-weighted assets in accordance with CRR/CRD IV dropped from EUR 82 billion in the previous year to EUR 74 billion. The leverage ratio under CRR/CRD IV fully loaded stood at 4.7 percent. "This makes us one of the best capitalized banks in Germany, giving us a risk structure appropriate to the size of our Bank and our business model," explained Hans-Jörg Vetter. Overview of expense and income items Net interest income came to EUR 1,654 million, down from EUR 1,878 million in the previous year. This reflects the low interest rates and the decline in interest-bearing assets. In addition, accounting-specific effects also exerted some pressure. At EUR 55 million, allowances for losses on loans and advances were substantially lower than in the previous year (EUR 104 million). The Bank was once again able to benefit here from the solid state of the companies in its core markets and the good quality of its loan book as a result of its conservative risk policy. Net fee and commission income declined moderately to EUR 498 million last year (previous year: EUR 518 million). Although income from the securities and commission business as well as loan syndicating rose, income from brokerage business, loan commissions and guarantees eased. Net gains/losses from financial instruments measured at fair value through profit or loss improved substantially over 2014, increasing by EUR 347 million to EUR 226 million. This was due to more volatile markets in 2015 and the resulting new business conducted in instruments for hedging exposure to foreign currency and interest rate risks. Lower valuation discounts for counterparty risk (largely credit valuation adjustments) also contributed to the positive development. Net gains/losses from financial investments and net income/expenses from investments accounted for using the equity method declined to EUR 94 million (previous year: EUR 263 million). This was due to the absence of securities valuation and realization effects as well as lower profit contributions from a venture capital company. The EUR 33 million increase in other operating income to EUR 134 million is primarily due to higher income from the sale of real estate investments held by the subsidiary LBBW Immobilien. Despite the high costs incurred in the modification of the IT architecture, with which the Bank is addressing the rising regulatory requirements and investing in its future viability, administrative expenses of EUR 1,782 million were virtually unchanged over the previous year (EUR 1,770 million). Charges also resulted from pay-scale adjustments to wages and salaries, while consulting and auditing costs declined. Expenses for bank levy and the deposit guarantee system , which are reported as a separate item in the income statement for the first time, came to EUR 73 million (previous year: EUR 82 million). The bank levy is the contribution to the restructuring fund established under European legislation, while the deposit guarantee system entails the amount that LBBW is required to pay into the protection scheme operated by the Savings Banks Finance Group. The guarantee commission for the risk shield of the State of Baden-Württemberg came to EUR 121 million. Net income/expenses from restructuring of minus EUR 44 million primarily comprises provisions set aside for measures to reorganize the private customer business. According to the preliminary figures, net consolidated profit before tax rose to EUR 531 million in 2015 (previous year: EUR 477 million). At EUR 422 million, net consolidated profit after tax was slightly down on the previous year, which had benefited from a low tax ratio as a result of nonrecurring effects. Operating segments a reliable source of income All three operating segments – Corporates, Retail/Savings Banks and Financial Markets – made a positive contribution to consolidated net profit. LBBW will publish the segment figures at its annual press conference in April. In its operating business, the Bank's focus on high advisory skills and sustainable customer relationships continued to pay off. This was particularly reflected in numerous large-volume financing and capital-market transactions. Thus, LBBW once again occupied the top position in the Schuldschein league tables in 2015 and was also named "Best Schuldschein Dealer” by market data provider CMDportal for the fourth consecutive time. As the overall winner of the renowned "ZertifikateAwards", the Bank was additionally able to demonstrate its product expertise. As previously reported, LBBW acquired Nord/LB's custodian bank activities, opened two new foreign representative offices and expanded its German Centre in Beijing. Furthermore, the Bank stepped up internal initiatives and projects in many areas in 2015 that are aimed in particular at enhancing efficiency and quality, and allowing it to address changing market and customer needs. This includes the planned change to a new core banking system in 2017, preparations for which are proceeding as scheduled. In addition, the Bank recently announced its intention to reorganize its private customer business. Against the background of digitization, BW-Bank shall be developed into a powerful multi-channel bank. LBBW will continue to move these projects forward this year and pursue the selective and risk-conscious expansion of its customer business. Outlook Despite moderate growth in the operating customer business, net consolidated profit before tax in 2016 is expected to be slightly lower than in the previous year, against the background of increased investments in the Bank’s future viability, particularly in IT, and the normalization of allowances for losses on loans and advances.

Preliminary business figures for the LBBW Group as at 31 December 2015

The above figures are preliminary only. LBBW will be presenting the consolidated financial statements for 2015 setting out the final figures at its annual press conference on 12 April 2016.