- Business model of a mittelstand-minded universal bank with a strong focus on sustainability proves its worth

- Net profit/loss before tax rises to EUR 428 million as at 30 June (2020: EUR 100 million)

- Net consolidated profit/loss after tax increases to EUR 283 million (2020: EUR 50 million)

- Strong operating performance, especially in Capital Markets Business, Corporate Customers and Real Estate/Project Finance

- Significant income growth

- Cost/income ratio (CIR) improves further to 67.2%

- Sound capital resources: Common equity Tier 1 (CET 1) capital ratio of 14.9%

- Return on equity of 6.3%

LBBW increased its profits strongly in the first half of 2021 while at the same time systematically implementing its strategic agenda. Consolidated profit before tax was EUR 428 million, up on EUR 100 million in the previous year. Net consolidated profit/loss after tax rose to EUR 283 million (previous year: EUR 50 million).

Rainer Neske, Chairman of LBBW’s Board of Managing Directors, commented: “Our very encouraging half-year figures are the result of considerable changes and modernization at LBBW over recent years. We expanded our growth areas as planned and keep our costs under control while simultaneously investing in sustainability and digitalization. This strategy is increasingly paying off.” Rainer Neske went on: “ The banking environment remains difficult. In light of this, we are continuing to work on developing LBBW further and permanently establishing ourselves as one of the top banks on the German market in terms of customer satisfaction, profitability and employee loyalty”.

Earnings were driven by good operating performance and a decline in allowances for losses on loans and securities compared to the previous year. The bank’s income climbed by a considerable EUR 160 million or 12% to just under EUR 1.5 billion.

LBBW's capitalization remains solid. The common equity Tier 1 capital ratio (CRR/CRD IV fully loaded) came to 14.9% (31 December 2020: 14.8%), again putting it well in excess of regulatory capital requirements. The total capital ratio was 22.1% (31 December 2020: 22.8%). Risk-weighted assets were nearly unchanged at EUR 82.5 billion. Return on equity improved to 6.3 % (previous year: 1.5%).

Growth areas expanded

At the same time, LBBW has continued to develop along its strategic cornerstones of business focus, sustainability, digitalization and agility. The bank made good progress in its growth areas, with corporate finance business, for example, performing extremely well with an increase in revenue by 10% compared to year-end 2020. The growth sectors of telecommunication/media and electronics/IT, pharmaceuticals/ healthcare and utilities/energy have again grown by 8% since the start of the year. Total assets in the Asset and Wealth Management business area rose by just under EUR 6 billion to EUR 135 billion. After taking over BayernLB’s interest-rate, currency and commodity management for savings banks’ corporate customers at the start of the year, we strengthened our savings bank business further by acquiring the interest-rate, currency and commodity management of HCOB (formerly HSH Nordbank).

Bank extends leading position in sustainability

LBBW underscored its pioneering role among the major German banks in the area of sustainability. The annual survey of 200 CFOs, treasurers and financial directors conducted by the business magazine “Finance” named LBBW as the best bank on the German market for sustainability and ESG advisory. In the first half of the year LBBW also issued the first social bond for private investors and converted the “LBBW Balance” umbrella funds to sustainability. The bank’s sustainable product range was also expanded further by way of LBBW Asset Management’s “Gesund leben” equity fund. We again arranged numerous sustainable finance options for our customers. In addition, LBBW participated in two further social bond issues under the European SURE program in the first half of the year. This comes on the back of accompanying a similar issue for the first time at the end of 2020. The bank was also a joint lead manager for the first green bond of the state of Baden-Württemberg.

LBBW is currently working hard on integrating future regulatory requirements in connection with achieving the Paris climate targets into its internal processes. It also reviews its sustainability guidelines on an ongoing basis. Recently, for example, it introduced a far stricter coal guidelines.

LBBW is also working continuously on advancing digitalization of both internal processes and customer interfaces. One milestone here was the first fully digital transaction to secure payments for trade transactions based on blockchain on the Marco Polo platform.

Significant improvement in income, lower allowances for losses on loans and securities

All in all, LBBW considerably boosted income in the first half of 2021 to EUR 1,496 million (previous year: EUR 1,336 million) on the back of good operating performance. Capital Markets Business performed particularly well in almost all product areas. Income also picked up in business with corporate customers and in the Real Estate/Project Finance segment. LBBW generated income of EUR 110 million from the ECB’s TLTRO III refinancing operations as the lending targets connected with the program were achieved.

In the first half of the year, LBBW's allowances for losses on loans and securities came to the amount of EUR 63 million. EUR 20 million of this was attributable to increasing the adjustments made last year in view of the potential effects of the coronavirus pandemic. Allowances for losses on loans and securities came to EUR 281 million in the previous year, the result primarily of one large insolvency and provisions for the potential effects of the coronavirus pandemic. There were no notable defaults in the first half of 2021 on account of the pandemic. The good quality of the lending portfolio is also reflected in the low non-performing loan (NPL) ratio of just 0.7%.

Total expenses rose to EUR 1,005 million (previous year: EUR 954 million). This includes higher expenses for the bank levy and deposit guarantee system for 2021 as a whole, which increased to EUR 137 million and were totally recognized in the first half of the year. In the previous year, the strains from this were EUR 19 million lower. Administrative expenses rose to EUR 868 million, up on EUR 837 million in the previous year.

Net consolidated profit/loss before tax improved considerably to EUR 428 million (previous year: EUR 100 million). After deducting income taxes of EUR 145 million, net consolidated profit after taxes amounted to EUR 283 million (previous year: EUR 50 million).

Operating segments at a glance

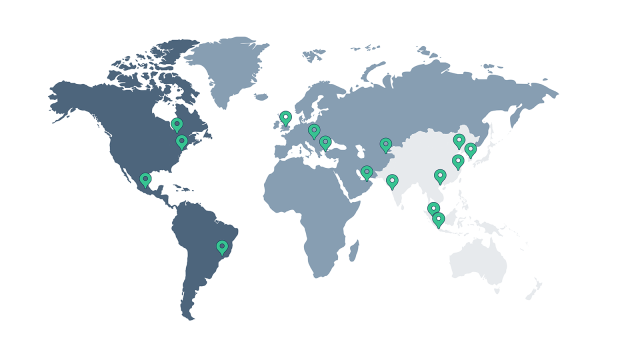

The Corporate Customers segment performed very favourably. Net profit before tax came to EUR 202 million thanks to strong customer business. Income also picked up this year in the growth area of corporate finance. Export financing was also in high demand. The high esteem in which customers hold LBBW in the field of foreign trade is also reflected in the fact that LBBW was named one of the top international banks for export financing for the third time by the specialist information service TXF. The segment also accounted for a large share of the TLTRO III refinancing operations. Allowances for losses on loans and securities remained far lower than the previous year’s figure, which was strained by the major insolvency.

The Real Estate/Project Finance segment increased its pre-tax profit substantially by 27% to EUR 136 million. The customers lending volume in the segment, which also benefited from the TLTRO III program, was stable at EUR 29 billion. New business was also on par with the previous year at around EUR 5 billion. Commercial real estate financing accounted for EUR 4.3 billion of this. One focal area here was on financing residential property. Project finance was focused on sustainable financing and digital infrastructure. Portfolio quality remains high, which is also clear from the fact that the pandemic has not resulted in any defaults.

The Capital Markets Business segment again exceeded the good previous year result, generating a pre-tax profit of EUR 172 million (previous year: EUR 125 million). Income saw a considerable upturn, driven in part by strong customers business in hedging and investment products, especially certificates. Administrative expenses declined slightly thanks to high cost discipline.

Securities transactions and the customers lending volume performed well in the Private Customers/Savings Banks segment. By contrast, income from payment transactions suffered a decline due to the crisis and the brokerage business remained at a low level. Also low interest rates affected the deposit business. Furthermore, provisions of EUR 12 million were recognized on account of the new ruling on making changes to general terms and conditions. This also caused net profit/loss to decrease to EUR 2 million (previous year: EUR 19 million).

Outlook

For the current fiscal year, LBBW expects a positive result in the three-digit million range and above the previous year’s figure.

Key figures for the LBBW Group as at 30 June 2021

Income Statement

|

01/01/2021 – 30/06/2021 EUR million |

01/01/2020 – 30/06/2020* EUR million |

Change in EUR million | Change in % | |

|---|---|---|---|---|

| Net interest income | 1,026 | 872 | 153 | 17.6 |

| Net fee and commission income | 294 | 274 | 20 | 7.3 |

| Net gains/losses on remeasurement and disposal | 51 | -182 | 233 | - |

| Other operating income/expenses | 62 | 90 | -28 | -31.2 |

| Total operating income/expenses | 1,433 | 1,055 | 378 | 35.8 |

| of which income | 1,496 | 1,336 | 160 | 12.0 |

| of which allowances for losses on loans and securities | -63 | -281 | 218 | -77.5 |

| Expenses | -1,005 | -954 | -51 | 5.3 |

| of which administrative expenses | -868 | -837 | -31 | 3.7 |

| of which bank levy and deposit guarantee system | -137 | -118 | -19 | 15.7 |

| of which net income/expenses from restructuring | 0 | 1 | -1 | -94.4 |

| Consolidated profit/loss before tax | 428 | 100 | 328 | >100 |

| Income taxes | -145 | -50 | -95 | >100 |

| Net consolidated profit/loss | 283 | 50 | 233 | >100 |

Figures may be subject to rounding differences. Percentages are based on the exact figures.

*Restatement of prior year amounts

Key figures

|

30/06/2021 in EUR billion |

31/12/2020* in EUR billion |

Change in EUR billion | Change in % | |

|---|---|---|---|---|

| Total assets | 304 | 276 | 28 | 10.0 |

| Risk-weighted assets | 83 | 82 | 0 | 0.3 |

*Figures may be subject to rounding differences. Percentages are based on the exact figures.

|

30/06/2021 in % |

31/12/2020 in % |

|

|---|---|---|

| Common equity Tier 1 capital ratio (CRR/CRD IV „fully loaded“) | 14.9 | 14.8 |

| Total capital ratio (CRR/CRD IV „fully loaded“) | 22.1 | 22.8 |

|

01/01/2021 – 30/06/2021 in % |

01/01/2020 – 30/06/2020* in % |

|

|---|---|---|

| Return on equity (RoE) | 6.3 | 1.5 |

| Cost/income Ratio (CIR) | 67.2 | 71.5 |

*Restatement of prior year amounts

| 30/06/2021 | 31/12/2020 |

Change in absolute terms |

Change in % | |

|---|---|---|---|---|

| Employees | 9,963 | 10,121 | -158 | -1.6 |

Segments at a glance

Corporate Customers

| 01/01-30/06/2021 EUR million | 01/01-30/06/2020* EUR million | |

|---|---|---|

| Net interest income | 491 | 414 |

| Net fee and commission income | 84 | 112 |

| Net gains/losses on remeasurement and disposal | -81 | -253 |

| Other operating income/expenses | 13 | 0 |

| Total operating income/expenses | 507 | 273 |

| of which income | 592 | 507 |

| of which allowances for losses on loans and securities | -85 | -234 |

| Expenses | -306 | -310 |

| of which administrative expenses | -285 | -294 |

| of which bank levy and deposit guarantee system | -20 | -16 |

| of which net income/expenses from restructuring | 0 | 0 |

| Consolidated profit/loss before tax | 202 | -37 |

*Restatement of prior year amounts

Real Estate/Project Finance

| 01/01-30/06/2021 EUR million | 01/01-30/06/2020* EUR million | |

|---|---|---|

| Net interest income | 201 | 152 |

| Net fee and commission income | 7 | 10 |

| Net gains/losses on remeasurement and disposal | -16 | -9 |

| Other operating income/expenses | 38 | 45 |

| Total operating income/expenses | 230 | 198 |

| of which income | 247 | 202 |

| of which allowances for losse on loans and securities | -17 | -4 |

| Expenses | -93 | -91 |

| of which administrative expenses | -84 | -82 |

| of which bank levy and deposit guarantee system | -10 | -9 |

| of which net income/expenses from restructuring | 0 | 0 |

| Consolidated profit/loss before tax | 136 | 107 |

*Restatement of prior year amounts

Capital Markets Business

| 01/01-30/06/2021 EUR million | 01/01-30/06/2020* EUR million | |

|---|---|---|

| Net interest income | 234 | 176 |

| Net fee and commission income | 65 | 48 |

| Net gains/losses on remeasurement and disposal | 115 | 145 |

| Other operating income/expenses | 4 | 1 |

| Total operating income/expenses | 418 | 370 |

| of which income | 418 | 370 |

| of which allowances for losses on loans and securities | 0 | 0 |

| Expenses | -246 | -245 |

| of which administrative expenses | -213 | -218 |

| of which bank levy and deposit guarantee system | -32 | -27 |

| of which net income/expenses from restructuring | 0 | 0 |

| Consolidated profit/loss before tax | 172 | 125 |

*Restatement of prior year amounts

Private Customers/Savings Banks

| 01/01-30/06/2021 EUR million | 01/01-30/06/2020* EUR million | |

|---|---|---|

| Net interest income | 132 | 146 |

| Net fee and commission income | 126 | 124 |

| Net gains/losses on remeasurement and disposal | 1 | -1 |

| Other operating income/expenses | -13 | -4 |

| Total operating income/expenses | 246 | 265 |

| of which income | 246 | 263 |

| of which allowances for losses on loans and securities | 0 | 1 |

| Expenses | -244 | -246 |

| of which administrative expenses | -244 | -246 |

| of which levy and deposit guarantee system | 0 | 0 |

| of which net income/expenses from restructuring | 0 | 0 |

| Consolidated profit/loss before tax | 2 | 19 |

*Restatement of prior year amounts

Corporate Items/Reconciliation/Consolidation

| 01/01-30/06/2021 EUR million | 01/01-30/06/2020* EUR million | |

|---|---|---|

| Net interest income | -33 | -16 |

| Net fee and commission income | 12 | -20 |

| Net gains/losses on remeasurement and disposal | 32 | -63 |

| Other operating income/expenses | 19 | 48 |

| Total operating income/expenses | 32 | -51 |

| of which income | -7 | -7 |

| of which allowances for losses on loans and securities | 38 | -44 |

| Expenses | -116 | -62 |

| of which administrative expenses | -41 | 3 |

| of which bank levy and deposit guarantee system | -75 | -66 |

| of which net income/expenses from restructuring | 0 | 1 |

| Consolidated profit/loss before tax | -84 | -113 |

*Restatement of prior year amounts