July 17, 2024

Capital market financing with a sustainability focus - is the hype over?

After years of growth, the market for capital market financing for companies with a sustainability focus stagnated in 2023.

Capital market financing - briefly explained

The capital market has a simple task: It brings capital seekers together with investors. LBBW mediates between the two sides. LBBW assumes the role of intermediary when it comes to sums that are too large for a normal loan - or when more favorable conditions are possible via the capital market. She has built up a first-class network of investors far beyond Germany's borders. Four forms of capital market financing are particularly attractive for companies: Schuldschein loans with broad syndication, corporate bonds, promissory note loans and ABS (asset-backed securities) solutions.

What capital market financing with a sustainability focus is available?

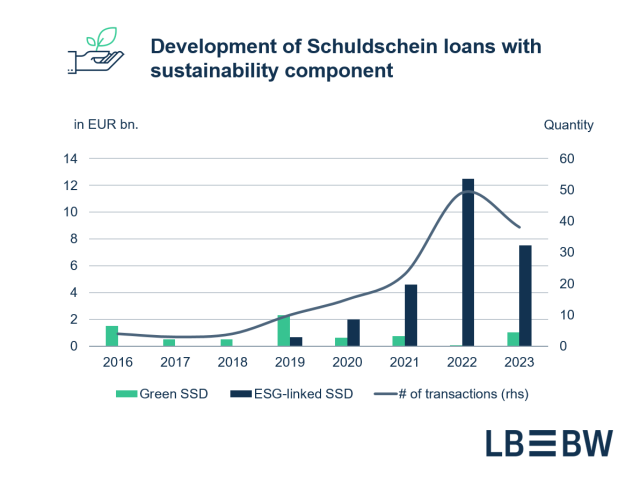

Capital market financing with a sustainability focus has experienced a real hype in recent years. Corporate bonds and the German Schuldschein in particular are increasingly being linked to sustainability criteria. In these sustainable finance capital market financings, a sustainability component is implemented in the form of E (environmental), S (social) or G (governance) or ESG hybrids.

This is possible via the use of funds, i.e. for financing with a sustainable purpose. This is not the case with sustainability-linked or ESG-linked capital market financing, which is linked to a sustainability rating or company-specific sustainability indicators (ESG KPIs).

How has the market for sustainable capital market financing developed?

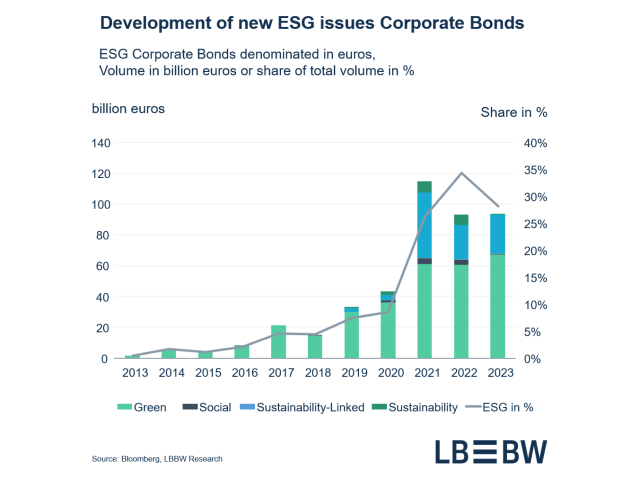

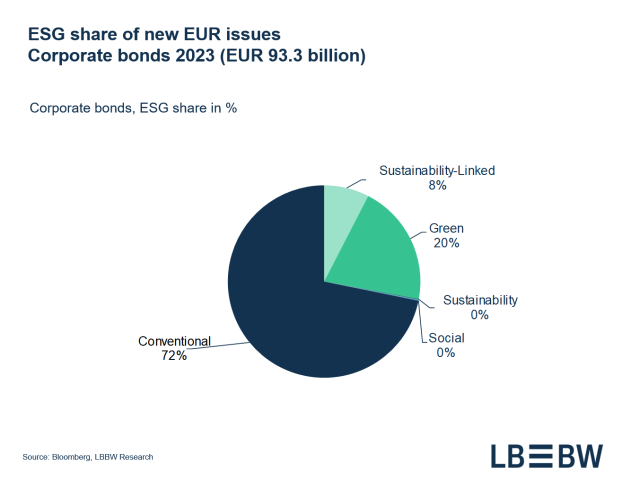

A look at the development of the bond market not only shows the increased importance of corporate bonds for corporate financing in general, but also the rising proportion of ESG-related transactions in particular. The market for corporate bonds has grown strongly with a recent market volume of around 94 billion euros. Promissory bills were also a popular financing solution for companies, with around EUR 31 billion in 2022 and EUR 23 billion in 2023.

At the same time, the proportion of capital market financing with a sustainability focus rose from less than 10% in 2019 to highs of 30% for corporate bonds and 40% for promissory note loans.

While the focus of corporate bonds is more on transactions focused on the intended use, linked financing clearly predominates in the case of promissory note loans. ESG has arrived in the financing world, but it seems that the rapid growth of recent years is over.

Is the hype over?

"Sustainability aspects in capital market financing are becoming increasingly important," says Dominik Buric, Co-Head Debt Capital Markets at LBBW, explaining this on the one hand with the increasing demand for sustainable investment opportunities on the investor side, but also with regulatory developments at banks, investors and the companies themselves. "For 2024, we expect similar shares of sustainable finance financing in both markets as in 2023 and a kind of plateau formation. However, we are noticing that ESG is gaining new relevance with regard to lending decisions, particularly among investors from the banking sector."

What impact does regulation - such as CSRD and the seventh MA risk amendment - have on the market for sustainable capital market financing

"It would appear that regulatory intervention is having a greater impact than the original voluntary commitment to greater sustainability," says Buric. Since January 1, 2024, the seventh MA-Risk amendment of the banking supervisory authority has been mandatory for banks. Among other things, it stipulates that ESG risks must be taken into account as part of the credit decision. "We recognize that bank investors' questions about sustainability aspects are also increasing in traditional transactions and that additional information is being requested from companies as part of the credit decision. This expands the perspective already familiar to investors in the asset management sector. Sustainability is perceived as future viability with greater long-term stability in the business model and increased return potential," Buric continues.

But regulation is also increasing the relevance of the topic for companies. The Corporate Sustainability Reporting Directive (CSRD) has significantly expanded the group of companies that must prepare a sustainability report and redefined content standards. "Many companies are currently undergoing a development process in order to meet the new requirements," reports Joachim Müller, Sustainability Advisor at LBBW. LBBW's Sustainability Adviory provides companies with comprehensive advice on all ESG financing solutions.

LBBW supports with many years of ESG expertise

Sustainable financing is part of LBBW's core business and LBBW has also supported and driven growth in capital market financing with a sustainability focus. This is reflected in the 66 sustainable finance transactions since 2018 and numerous ESG advisory mandates from SMEs to DAX companies.

"We support companies in all project phases. From strategic preparation for CSRD compliance to targeted KPI development for specific financing projects," explains Joachim Müller.

He predicts that ESG-linked capital market financing will continue to play an important role for a transitional phase - until the full publication of sustainability reports by companies from 2026 - and recommends using a business model-specific KPI set instead of an external sustainability rating. "We are seeing an increasing trend and greater acceptance from investors and banks, which is also exemplified by 54% KPI transactions vs. 46% rating transactions in the Schuldschein market figures for 2023," explains Joachim Müller.

Karl-Heinz Bühner, Co-Head Debt Capital Markets at LBBW, points out another aspect of capital market financing for companies: "Investors today expect companies to be more transparent - and not just with regard to sustainability aspects. Investor care through additional information in sustainability reports and investor conferences is desired."

Do you have any questions or would you like to know more?

Please contact us.