January 03, 2025

Germany's long road to the here and now

The country’s economic structure fits ever less into the 21st century.

Welcome to the year 2025! In my Christmas newsletter , I tried to cheer you up a little with a bouquet of good news. Alas, I must now return to the same old, same old and address a difficult topic. Germany is the undisputed market leader in 20th century products. Unfortunately, we are now well into the 21st century.

The German export boom is over, well and truly

The German economy had enjoyed an enormous export expansion, particularly at the beginning of the century. It was driven not only by high-quality products, but also by two supporting structural changes. Firstly, the introduction of the Euro meant that German companies were able to export super-competitively to the rest of the world with a currency that was fundamentally undervalued. An appreciation of the Deutschmark, which would have made short thrift of the export boom, could no longer happen. I am convinced that Germany benefited more from the single currency than any other country. Secondly, China emerged as a new player in global trade. The massive investment drive in China increased demand for German equipment, mechanical engineering products and vehicles. All the stuff that traditionally had a "Made in Germany" sticker on it. But in the meantime, China itself has become an industrial powerhouse and no longer needs to import as much from Germany. The German export driven growth model is irretrievably passé.

A product update is needed

And this is not just the result of burgeoning protectionism and a less dynamic global economy. Germany has become a bit smug during the past streak of export successes. As a result, there is now less and less demand for the German products worldwide.

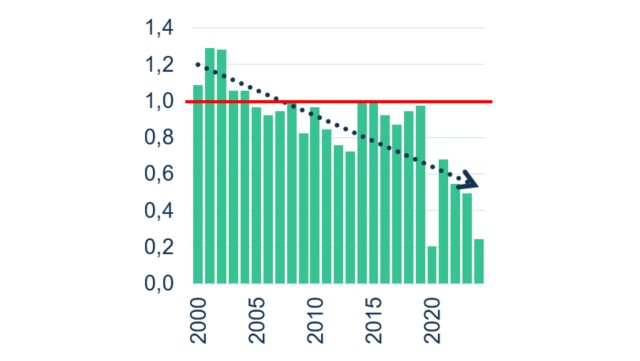

Figure 1 shows the "elasticity" of German exports in relation to the expansion of the global import demand. A value of 1 is to be interpreted as German exports growing in line with the global demand. Until the financial crisis, German exports expanded at a disproportionately rapid rate ("high elasticity"): values were above the 1, outgrowing global trade. In the recent past, however, German products have been less and less in demand worldwide (elasticity below 1). The trend (dashed line) speaks loud and clear.

Fig. 1: German exports are less in demand (elasticity of German export growth with respect to global import growth, 5-year-avg.)

Germany must catch up in future technologies

Alas, a trend reversal is not to be expected. The bestsellers of the 21st century are data-driven and have a high digital technology content. And it is precisely in these areas that German companies are not investing enough. Figure 2 shows that far too little is being invested in information and communication technology (ICT) and intellectual property products (IP). By ducking the technologies of the future, Germany will not regain its export prowess. A mindset shift is needed. Away from trying to preserve the successes of the past and towards embracing the products and ideas of the future. That is risky. That is breaking new ground. But that is also the only way forward.

Fig. 2: Share of total gross fixed capital formation (%, 2013-2023)

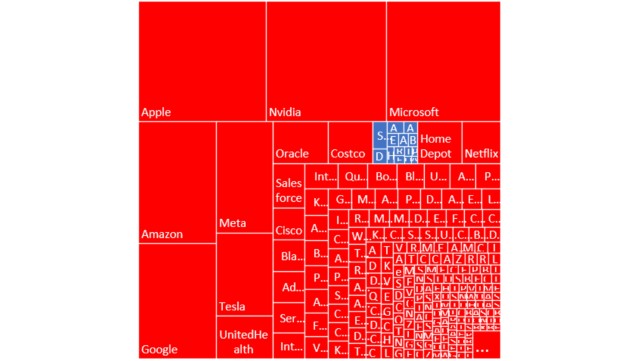

America is leaving Europe in the dust

The delayed structural change is not just a purely German challenge: Figure 3 shows that there are hardly any successful young companies in Europe. All European companies younger than 50 years old but worth more than 10 billion dollars (in blue) are collectively worth just as much as Home Depot alone! We must endorse the future, lest our economy will turn into a museum. This shift not only includes a business environment that encourages research, development and entrepreneurship. But many companies will also have to endorse change and confront the opportunities ahead head-on. The world is not waiting for us.

Fig. 3: Value of public companies younger than 50 years with market capitalization at least $10 billion

Source: Andrew McAffee , LBBW Research. Size of areas proportional to market capitalization.

US companies in red, EU companies in blue.

Download To the point!

-

287.1 KB | January 03, 2025

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom. This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States. LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Ger many) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Ger many) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for individual investment advice, please contact your investment advisor. We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice. Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance. The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient. Additional Disclaimer for recipients in the United Kingdom: Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.