November 29, 2024

The U.S. is playing a risky fiscal game

Trump is poised to worsen the public debt problem.

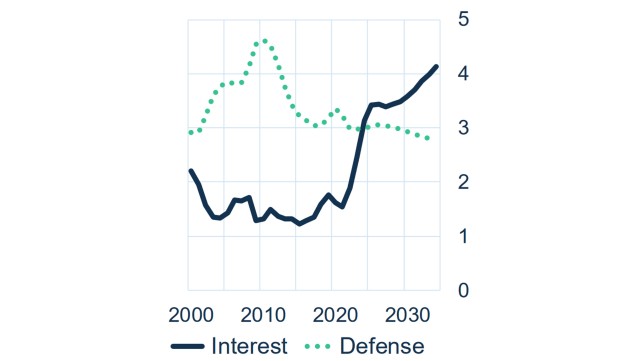

This year, the public finances of the U.S. have reached a critical point: For the first time, the federal government has to spend more on interest payments than it does on defense (see graph). According to Ferguson’s Law, a phenomenon discovered by Scottish-American historian Niall Ferguson, a nation that spends more on interest than on the military is on the brink of geopolitical decline. This was the fate of Habsburg Spain, the Ottoman Empire, the British Empire, and pre-revolutionary France. And now, the United States of America?

The forecasts shown in the figure do not even consider the additional debt and the resulting higher interest burden that can be expected from Trump's expansionary budget policy. If he cuts taxes he has promised during the election campaign, public debt will increase faster by an additional quarter of the national income in the next ten years than it would have under unchanged fiscal policy. And the situation is already critical: Despite the absence of recession and war, the American budget deficit is around 7% of GDP. Any clear-thinking economist would be gasping for air. Because one thing is certain: U.S. public finances are anything but sustainable.

Federal Spending U.S. (% of GDP)

Who will purchase all the government debt?

If Washington does not take countermeasures, the national debt would, according to calculations by S&P Global, rise from just over 120% today to nearly 230% of GDP by 2060. That is almost unimaginable. Even now, the question arises of who will buy the future tsunami of U.S. government bonds. In the next ten years, net issuances of an estimated $2 trillion annually are expected. Unlike in the 2010s, the U.S. Federal Reserve (Fed) and foreign central banks will no longer be net purchasers. Instead, the Fed is reducing its bond holdings, and global currency reserves are stagnating. China’s central bank has reduced its holdings of U.S. Treasuries over the past ten years.

The federal interest burden: up, up, and up some more

Consequently, price-sensitive buyers, such as American households and institutional investors, will constitute an increasing share of Treasury investors. This also means that not only does the issuance volume increase, but Washington will also have to offer higher interest rates. As a result, the budget will become even more skewed.

Interest expenses will rise to more than 6% of GDP by the 2050s. In 2022, the corresponding figure was still below 2°%. And if, as some expect, the risk premium rises by around 100 basis points, the interest burden will climb even faster. The deficits of the U.S. government would permanently be almost half of the total revenues of the U.S. federal government!

The privilege of the world reserve currency still holds

So, will Ferguson’s Law strike once again? Are the days of American supremacy in the capital markets numbered? Not quite yet! Despite Washington's deficit spending spree, there is no credible replacement for the dollar in sight. It’s not the euro, the currency of a crisis-ridden continent, nor the non-convertible yuan. But the dollar's privilege as the world's reserve currency is not a license for unrestrained indebtedness. The time will come when investors will increasingly shun U.S. government bonds. A financial crisis would inevitably follow.

That moment is not around the corner. But Trump's unrestrained budget behavior is an unforced error, bringing it closer without necessity...

Download To the point!

-

238.7 KB | November 29, 2024

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom. This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States. LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Ger many) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Ger many) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for individual investment advice, please contact your investment advisor. We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice. Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance. The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient. Additional Disclaimer for recipients in the United Kingdom: Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.