October 31, 2024

Trump or Harris? The mother of elections

Germany must hope for a victory for the Democrat candidate.

The time has finally come. On Tuesday, after a seemingly endless election campaign full of dramatic scenes such as assassination attempts and candidate resignations, things are now going down to the wire. It is still unclear who will reside in the White House in the future. However, Donald Trump is currently the clear favorite and has taken a lead in most swing states. He has the momentum on his side. Figure 1 shows the probability of a Trump victory as measured by the LBBW Trump-O-Meter, which takes polls, betting odds, and our own expert opinions into account. The trend speaks for itself.

Figure 1: The LBBW Trump-O-Meter

Probability of a Trump election victory

⬤ {series.name}: {point.y}

Trump's love for tariffs

Tariffs to curb imports into the U.S. are a central plank in Donald Trump's economic policy strategy, or at least in his economic policy ruminations. Trump sees global trade as a zero-sum game. What one man wins, the other must lose. Of course, anyone who has attended Economics 101 knows that this interpretation is fundamentally mistaken. Trade, including cross-border trade, benefits everyone involved. But for Trump, the US trade deficit means that surplus countries are exploiting hard-working U.S. families. And with the trade deficit running at around $ 100 billion a month, this imbalance is a big (perceived) problem for Team Trump.

This is why Trump keeps repeating in election campaign speeches and media interviews that all imports into the USA will be subject to a general tariff of between 10 % and 20 %, irrespective of product or origin. Imports from China, a particular Trumpian bugbear would even be slapped with a 60 % general tariff. In a TV interview, Trump recently stated that "tariffs" was not only his absolute favorite word in the dictionary (ahead of "love" or anything else!). But he went further claiming that tariffs could also replace income taxes altogether (no, they can’t, because this would cause a fiscal meltdown).

There is nothing ambivalent here: if Trump wins, he wants to erect high tariff walls. A global trade war looms. Since Congress has largely delegated its right to impose tariffs to the executive branch, a president Trump could turn his announcements – or better: threats – quickly and smoothly into action.

A trade conflict means recession in Germany

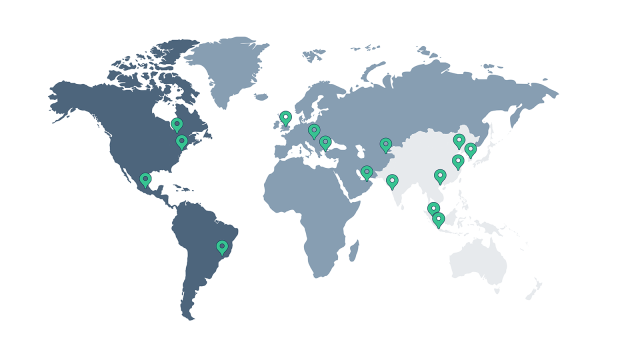

Germany is a particularly open and exportdependent (we used to say "export-strong") economy. Almost half of the value-added produced in this country is sold across national borders. By comparison, the export ratio in the United States is mere 12 % of GDP. Hence Germany has a lot to lose. Exports to the U.S. alone account for close to 4 % of Germany’s GDP. With exports amounting to € 158 billion in 2023, the USA was by far the most important destination for our exports (see Figure 2).

Figure 2: The top 5 export destinations in Germany

With a monthly export surplus of $ 7 billion, Germany is likely to infuriate a President Trump particularly. Only China and Mexico, the latter in a free trade zone with the U.S., have larger surpluses. However, higher tariff walls also mean that German companies will invest even more in the U.S. to produce behind the tariff walls in order to remain competitive in serving the local market.

All in all, under the scenario that Trump puts his tariff announcements into practice, there is a threat of a tangible recession in Germany in 2025, of up to minus 2 %. Anyone who cares about the German economy should therefore keep their fingers crossed for Kamala Harris on Tuesday night!

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom. This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States. LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Ger many) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Ger many) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for individual investment advice, please contact your investment advisor. We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice. Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance. The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient. Additional Disclaimer for recipients in the United Kingdom: Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.