January 24, 2025

Choose your parents wisely!

In Germany, parental background heavily influences skill levels.

Since the PISA shock of 2000, we have become familiar with the regular international OECD performance tests for students. After Germany's dismal showing in the PISA tests back then, the performance of German students initially improved, but over the past ten years, they have slipped back to the middle of the pack. And what about us oldies who have long left the classroom behind? To investigate skills of the broader population, the OECD has recently conducted a PISA-comparable test among adults. To cut to the chase: Germany is not at risk of failing, but it is far from being the best in class. Are you ready for the report?

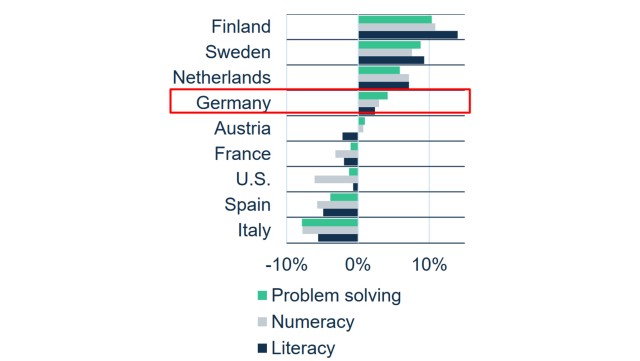

Fig. 1: Deviation from OECD average

Germany is a country of substantial educational inequality

As Figure 1 demonstrates, the overall data for Germany is actually quite encouraging. In all three tested categories (reading, problem-solving, and numeracy) the country outperforms the OECD average. However, the details reveal an unusually large performance disparity. The results highly depend on the individual's position in society. Germany faces a structural problem in education equality. Figure 2 illustrates the wide spread of results. The average performance of adults in Germany with a university degree exceeds the OECD average by more than 5%. Something seems to be working at German universities. However, the flip side of the coin is that adults without higher secondary education perform significantly worse than the international norm in all categories. In fact, among the 29 countries surveyed, Germany ranks second in terms of educational disparity between adults with basic and higher education, trailing only the USA. The need for urgent reform towards a more inclusive education system is evident.

Fig. 2: Socioeconomic determinants of adult educational attainment

A similar pattern is observed in the education of migrants. Germany lags behind in the OECD in integrating first-generation immigrants, while "natives" perform significantly better than their OECD peers (Figure 2, middle panel). Unfortunately, there is little hope for improvement. PISA results for students unequivocally show that Germany continues to rank poorly in integrating the next generation of migrants.

The apple does not fall far from the tree

Finally, it is striking how strongly the knowledge of the tested adults depends on the educational level of their parents (Figure 2). If at least one parent already has an academic degree, Germans with a university degree perform 4.3°% better than the average OECD adult with a comparable family background. Yet, if neither parent had enjoyed an upper secondary education, adults in Germany score significantly worse than the international comparison. Nowhere else in the 29 countries included in the sample does parental education determine the intellectual abilities of the offspring as much as it does in Germany.

The results remind us of an uncomfortable truth: Contrary to the often-encountered self-perception, Germany is a country with exceptionally low social mobility. Children of poorer parents are more likely to remain poor themselves than elsewhere. In Germany, it takes an average of six generations for descendants of a low-income family to reach the average income. In the OECD average, it takes 4.5 generations and only two generations for top performer Denmark. Only in emerging economies is socioeconomic immobility more pronounced than here! In light of a shrinking working population, Germany can no longer afford this caste-like impermeable segmentation. On February 23, Germany will elect a new parliament. The new government urgently needs to ensure better educational opportunities for all.

Download To the point!

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom. This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States. LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Ger many) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Ger many) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for individual investment advice, please contact your investment advisor. We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice. Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance. The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient. Additional Disclaimer for recipients in the United Kingdom: Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.