February 14, 2025

Germany on the eve of elections – part 1

Electoral manifestos and growth: What the parties offer

Germany's economy remains mired in stagnation. In the midst of an election campaign heavily dominated by economic policy issues, every party is promising a fresh start towards economic recovery. This is understandable and welcome. But the question is, how much substance lies behind the average 24,000 words of the programs? What do the party platforms truly offer? Are these promises mere smoke and mirrors, or is there a genuine prospect that reforms could revitalize our economy?

Which party has the most growth-friendly program?

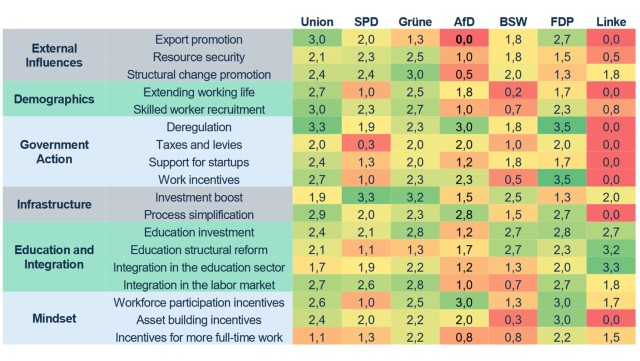

The analytical team at LBBW Research has taken on these questions by thoroughly examining the parties' election manifestos. At the end of 2024, we published the " LBBW Stagnation Study " in which we identified the causes of weak growth. Now, we take it a step further. We have analyzed the party platforms based on these growth inhibitors and rated their proposed solutions on a scale from 0 (= the issue is not addressed or a party’s plan has a negative impact) to 4 (= it is a central aspect of the program, backed by plausible measures).

Growth-friendliness of electoral programs

Unweighted average across all categories

No party has apparently discovered the holy grail for growth. The conservative Union parties (CSU in Bavaria and CDU in the rest of Germany) and the liberal FDP have prominently featured the economy in their election campaigns. As expected, they score above average, though not exceptionally so. The parties on the political fringes, such as The Left (Die Linke) on the far-left and the Alternative for Germany (AfD) on the far-right, however, have fewer economic policy proposals. It might come as a bit of a surprise to some that the Greens (die Grünen) are among the frontrunners at eye-level with the conservative parties. A closer look at the detailed results reveals that this is mainly due to their focus on investment, structural change, education, and integration.

The Union parties and the FDP are similar in that both strongly address deregulation and the associated reduction of red tape for businesses and citizens. To achieve these goals, they propose practical measures. However, both parties face financial constraints when it comes to providing new resources for an investment push, as they remain committed to the debt brake.

While no party presents a program capable of breathing new life into the economy, all parties offer some constructive aspects. This is evident in the detailed analysis of policy areas. Given that no party is expected to be able to govern alone, it is to be hoped that a coalition will yield even better results.

One standout in the AfD's platform is their call for an EU exit ("Dexit") . If implemented, this plan would be a severe blow to Germany's export-dependent economy. Thus, from an economic policy perspective, the AfD's program would essentially be a non-starter. However, apart from this self-destructive proposal, the AfD does contain some elements that could make sense in isolation, such as family income tax splitting and deregulation.

Download To the point!

-

307.8 KB | February 14, 2025

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom. This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States. LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Ger many) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Ger many) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for individual investment advice, please contact your investment advisor. We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice. Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance. The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient. Additional Disclaimer for recipients in the United Kingdom: Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.